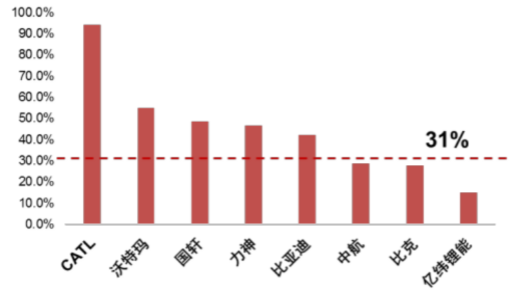

In 2017, domestic sales of new energy vehicles reached 777,000 units, and its market share rose to 2.7%, an increase of nearly 1 percentage point from last year, further increasing the demand for power batteries. According to statistics, in 2016, the number of power battery enterprises above designated size in China reached more than 150, and it gradually decreased to about 120 in 2017. As the technical requirements for domestic power battery products increase, new energy vehicles will be subsidized and the power battery industry will enter a new round of competition. The industry structure is undergoing new changes. Compared with 2016, the total installed capacity of lithium battery companies in 2017 increased, and lithium battery suppliers can be found. The rankings have undergone tremendous changes, and the power battery industry has shown new development characteristics. 2016 Power Battery (Lithium) Installation Top 20 Enterprise Rankings (Mwh) 2017 Power Battery (Lithium) installed 20 strong Business Ranking (Mwh) Rank Battery manufacturer market share Battery manufacturer market share Installed capacity 1 BYD 27.59% CATL 29.41% 9865.9 2 CATL 21.33% BYD 16.12% 5406.8 3 Waterma 9.26% Waterma 6.00 % 2011.4 4 Guoxuan Hi-Tech 5.88% Guoxuan Hi-Tech 5.74% 1925.2 5 Tianjin Lishen 4.30% Bik 4.34% 1454.3 6 Bik 2.73% Fuenergy Technology 3.15% 1057.8 7 universal 2.02% Tianjin Lishen 2.77% 929.6 8 Harbin Coslight 1.86% Beijing National Energy 1.95% 655.4 9 CNAC Lithium 1.81% Billion Wei Lithium Energy 1.89% 633.4 10 Beijing National Energy 1.57% Suzhou Xingheng 1.67% 558.7 11 Gugli 1.55% Zhejiang Tianneng 1.66% 556 12 Zhuhai Yinlong 1.45% Jiangsu Zhihang 1.59% 534.5 13 Suzhou Xingheng 1.31% Zhuhai Yinlong 1.52% 508.3 14 Hai Sida 1.03% Far East Foster 1.43% 479 15 Fuenergy Technology Average <1% universal 1.18% 397.5 16 Pride CNAC Lithium 1.17% 392.3 17 Qianjiang Lithium Micro Acer 1.17% 391.9 18 Beijing Electronic Control Shanghai De Longneng 1.13% 377.7 19 Micro Acer Guangdong Tianjin 1.09% 366.9 20 Fluoride Gugli 1.06% 356.1 Source: True Lithium Research 1. The market competition is changing and the third/fourth-tier industry is extremely unstable In 2016, the top 20 domestic power battery market share was 88.44%, of which more than 4% were 5 companies, and 6 market share was less than 1%. The first echelon was BYD and Ningde, with a market share of more than 20%; the second echelon was Waterma, Guoxuan Hi-Tech, and Tianjin Lishen with a market share of 4%-10%; the third echelon was BAK. With a market share of over 2%, the fourth echelon is a group of enterprises such as Harbin Coslight and CNAC Lithium, with a market share of approximately 1%. In comparison, the market share of the top 20 domestic power battery companies in 2017 was 86.04%, a decrease of 2.4%, of which more than 4% were still 5, but the TOP5 market share was 61.61%, and the market was down by 6.75%. . The first echelon of the power battery industry is still BYD and Ningde, with a market share of more than 16%; the second echelon is Waterma, Guoxuan Hi-Tech, BAK, and the market share is between 4% and 10%; the market structure appears. Change; the third echelon is Fu Energy Technology, Tianjin Lishen, share of 2% -4%; the fourth echelon has undergone major changes, some companies withdraw, a few companies entered the new, but the market share of all companies exceed 1%. 2. The overall concentration of the industry is reduced and the leading position of the industry needs to be further strengthened As a whole, the concentration of domestic power battery industry is not high. In 2017, the domestic TOP10 concentration of power battery industry was 73.04%, TOP5 was 61.61%, and TOP3 was 51.53%, both slightly lower than 2016 levels. TOP10 TOP5 TOP3 2017 Power Battery concentration 73.04% 61.61% 51.53% 2016 Power Battery concentration 78.35% 68.36% 58.18% On a single company, in 2017, the CATL power battery installed capacity was 9,865.9 Mwh, with a market share of 29.41%, which occupies the absolute leading position in the industry. In comparison, the share of the championship BYD in 2016 fell to 16.12%. Although the market share exceeded 13.29%, it still ranked second in the market. This is mainly due to the fact that CATL products are supplied to complete vehicle companies in the industry. There are few high-quality companies that can stably supply high-quality batteries, and their market demand is large. BYD is mainly responsible for the internal products of the Group, and the power battery products are being made of lithium iron phosphate. To the direction of the three yuan lithium battery transformation. 3, industry competition, product technology for the market to win the key At present, the internal competition in the domestic power battery industry is becoming more and more fierce. “Upgrading battery energy density and reducing costs†is a top priority for power batteries. The level of product technology determines whether companies can enjoy the dividends brought about by the new energy vehicle era. In fact, six companies ranked in progress in 2017, and two remain unchanged. Among them, catl sprint to the first, mainly in product technology is excellent, battery system or battery core energy density is high, product consistency is good, and for the whole industry of new energy vehicle vehicle support, won the absolute competitive advantage. The biggest improvement is Fu-Energy Technology, which has increased its ranking by 9 positions, mainly because its own product technology is relatively hard (no major quality accident has occurred yet, it will reach 300wh/kg in 2020), and its production capacity will be sufficient (35GWh in 2019). The domestic new energy main engine plant Beiqi New Energy has established a strategic cooperative partnership supporting Beiqi New Energy Vehicles. Rank 2017 Battery manufacturer market share Battery manufacturer market share Ranked higher than 17 years Whether listed 1 CATL 29.41% BYD 27.59% +1 preparing 3 Waterma 6.00 % Waterma 9.26% constant Yes 4 Guoxuan Hi-Tech 5.74% Guoxuan Hi-Tech 5.88% constant Yes 5 Bik 4.34% Tianjin Lishen 4.30% +1 Yes 6 Fuenergy Technology 4.01% Bik 2.73% +9 8 Beijing National Energy 1.95% Harbin Coslight 1.86% +2 Yes 10 Suzhou Xingheng 1.67% Beijing National Energy 1.57% +3 Yes 17 Micro Acer 1.17% Qianjiang Lithium <1% +2 4. If you go against the water, you will retreat if you do not enter the boat. The traditional luxury is limited by the technical route and production capacity. In the year of 2017, there were 5 companies that ranked backwards, and 2 companies had obvious backward steps, which were mainly limited by the technical route and insufficient capacity of lithium iron phosphate batteries. Both BYD and Zhuhai Yinlong are retreating a little. The former is mainly affected by the transformation of industry product support factors and product technology routes, while the latter may be due to the restriction of niche power battery products (lithium titanate), and the overall demand is small. Among them, Tianjin Lisheng efficiency production capacity is 3Gwh, and it has been deployed in production bases such as Tianjin, Beijing, Suzhou, and Qingdao. It was started and put into production in May 2017, which is likely to be limited by capacity constraints. The transformation of the lithium iron phosphate technology route is also one of the reasons. . However, Wanxiang and Nugget power batteries declined significantly, with 8 and 9 retreated respectively. The two companies may be more limited by the impact of capacity. Taking Wanxiang as an example, in 2017, R&D production of power batteries was accelerated, with layouts in the United States in Michigan, Boston, and Hangzhou. It is mainly used as a high-end power battery for passenger vehicles. It is understood that its effective production capacity is 2Gwh. Energy-based, energy-powered and power-type lithium-ion power battery products were introduced to strategic investors in May 2017. By the end of 2017, the power battery capacity will reach 4GWh. In addition, Nuggi is also significantly limited by the impact of the lithium iron phosphate technology route. Rank 2017 Battery manufacturer market share Battery manufacturer market share Ranked higher than 17 years Whether listed 2 BYD 16.12% CATL 21.33% -1 Yes 7 Tianjin Lishen 2.77% universal 2.02% -2 Yes 13 Zhuhai Yinlong 1.52% Suzhou Xingheng 1.31% -1 15 universal 1.18% Fuenergy Technology 1.03% -8 19 Gugli 1.06% Gugli 1.55% -9 Yes 5. Frequent emergence of black horses in power battery industry, listed companies as the main body At present, a number of domestic listed companies have entered the power battery industry of new energy vehicles, which has greatly promoted the competition in the industry. Among the top 10 companies in the industry, among them, Yiwei Lithium, Jiangsu Zhihang, Far East Foster, Shanghai Delangeng and Guangdong Tianjin are all listed companies. Among them, the market value of Lithium lithium energy from the original 20 The yuan rose to 20 billion. It can be said that Yilv Lithium Energy is a “dark horse†for power battery companies. In 2017, Lithium Energy became the 10th among the top 20 in the industry. It mainly benefited from the 7GWh production capacity that has been formed in 2017, and product support of different technical routes such as square lithium iron phosphate, cylindrical ternary and soft lamination, and established a number of strategic cooperations such as Nanjing Jinlong, Jiangsu Caway, and Luzhou Zhouzhou. Partnerships. Rank 2017 Battery manufacturer market share Battery manufacturer market share Ranked higher than 17 years Whether listed 9 Billion Wei Lithium Energy 1.89% CNAC Lithium 1.81% New Top Ten Yes 11 Zhejiang Tianneng 1.66% Gugli 1.55% New 20th 12 Jiangsu Zhihang 1.59% Zhuhai Yinlong 1.45% New 20th Yes 14 Far East Foster 1.43% Hai Sida 1.03% New 20th Yes 18 Shanghai De Longneng 1.13% Beijing Electronic Control <1% New 20th Yes 19 Guangdong Tianjin 1.09% Micro Acer <1% New 20th Yes Domestic power companies such as Zhejiang Tianneng, Jiangsu Zhihang, Far East Foster, Shanghai Delangeng, and Guangdong Tianjin have seized the opportunity of market explosion for pure electric commercial vehicles (including dedicated logistics), and quickly become a power battery company. twenty. Among them, Far East Foster has provided support for new energy auto companies such as JMC, Zhongtai, Dongfeng, Chery, Shaanxi Auto, and Shanghai Delong can give Dongfeng passenger cars, Xiamen Golden Dragon, space and time new energy, Chengdu Dayun, etc. Enterprise supporting power battery. This has benefited more from the low technical barriers in the domestic power electric commercial vehicles (including specialized logistics) supporting power batteries. Through capital operation, the company has fully integrated the talents and technologies in the field of power batteries, basically able to better meet the second and third lines. Or enter the new supply of new energy auto companies. Based on the analysis of the changes in power battery shipments in 2016 and 2017, we can make the following trend judgments: 1. The power battery industry will still be in the reshuffle stage. The strong will be Hengqiang, and the “Matthew Effect†will become increasingly obvious. The Action Plan for Promoting the Development of Automotive Power Battery Industry was released in March 2017. It is clear that by 2020, the specific power of battery cells exceeds 300Wh/kg, the system specific energy will strive to reach 260Wh/kg, and the total production capacity will reach 100GWh, forming a 40GWh leader. The system cost has been reduced to 1 yuan/Wh, which puts high demands and tests on the enterprise to increase the energy density of the battery system and reduce the cost. Judging from the capacity utilization rate of domestic power battery companies, as of June 2017, the domestic integrated utilization rate of power batteries was about 31%, of which the capacity utilization rate of CATL was more than 94%. BYD, Waterma, and Guoxuan Hi-Tech The capacity utilization rate of the other giants is 40%-55%, but capacity utilization rates of power battery companies such as CNAC Lithium Battery, BAK Battery, and Yiwei Lithium Energy have slipped below the average. For the power, battery, and technology-intensive power battery industries, small and medium-sized companies with poor profits or even losses will be accelerated. Figure 1 Capacity utilization rate of major battery companies in the first half of 2017 According to the market share of power batteries in 2017, the industry has emerged as an oligopolistic company. The market share in Ningde has exceeded 25% and is close to 30%. Recently, Ouyang Minggao, an academician of the Chinese Academy of Sciences, proposed that “the safety of electric vehicles is the first and the performance index is secondâ€. In fact, domestic product safety and comprehensive performance in the Ningde era are at the leading level, and it belongs to the third-party power battery company in the industry. It is the most attractive power battery supplier in China's auto companies, which will rapidly open the “battery oligarch†and the industry. The gap between the market share of the second and third-tier companies. 2. Small and medium-sized power battery companies will strengthen strategic cooperation with new energy vehicle companies In general, the domestic power supply of new energy vehicle companies will use large-scale probabilistic joint ventures, third-party procurement models, or power battery industry leaders, and may have a stronger voice when purchasing high-quality power batteries. The downside is that it is difficult for OEMs to maximize the profits of new energy automotive products, and it will also lead to homogenous competition among competing products. These are not the best results that vehicle companies want to see. With the intensified competition in the power battery industry, both the revenue and profitability, the advantages of leading power battery companies will become even more prominent, and will inevitably lead to the introduction of inefficient production capacity. Then, this will enable OEMs to actively integrate industries with accumulated power battery core technologies to achieve power battery self-manufacturing; or to promote deep collaborative development of vehicles and power battery companies and even industrial chain companies; or indirectly promote small and medium power Battery companies actively seek out joint ventures and cooperation of OEMs to minimize cost pressures. To a certain extent, the power battery industry will rely on deep cooperation or joint venture cooperation in the form of auto factories, and establishing a stable industrial chain collaboration relationship is imminent. 3, the competition of power battery industry will still return to product technology, soft pack battery technology or direction According to the network subsidy policy, subsidies for new energy vehicles in 2018 will experience a significant reduction, and technical requirements such as battery system energy density will still determine the amount of subsidy for new energy vehicles, which will also affect new energy vehicle companies and Power battery profitability. From the perspective of the supporting applications of power batteries with cruising range of 150 km to 500 km, Beiqi, SAIC, Geely, GM, Ford, Renault and Hyundai mainly use soft pack batteries; Beiqi, SAIC, Geely, BYD, and BMW use square batteries. Tesla uses cylindrical batteries. Relatively speaking, soft-battery batteries have a higher degree of application. From a technical point of view, the power battery energy density of the square and soft pack ternary systems can exceed 140 Wh/kg, compared to the energy density of the soft pack ternary system is relatively easy to achieve. Power Battery Energy Density (Wh/kg) Cylindrical Ternary Monomer Cylindrical ternary system Square ternary monomer Square ternary system Soft pack ternary monomer Soft Package Ternary System 2016 180 130 180~200 120~145 200~220 130~150 2017 215 140 190~210 130~150 210~240 140~170 4. The pace of merger and reorganization of power battery companies is accelerating, and the industry may enter a new era of “big fish eat fish†Combined with GGII survey data, China's power battery production in 2017 is 44.5GWh, while the domestic mainstream power battery production capacity will reach 79Gwh, overcapacity highlights, which means that the product structure needs to be optimized, will promote the merger and reorganization of the industry, promote the power battery Horizontal mergers and acquisitions between enterprises, or vertical mergers between vehicles and power battery companies. enterprise 2017 capacity and expansion client Product Match Analysis CATL Has 18Gwh capacity SAIC, BMW, Citroen, Volkswagen, Yutong Large capacity, business and transportation, including mainstream automotive brands at home and abroad BYD Capacity 16Gwh BYD Large capacity, business and transportation, rely solely on self-provisioned; although sales have been released, competitors do not buy it Guoxuan Hi-Tech 9Gwh Beijing New Energy, JAC, Zhongtong, SAIC Mainstream New Energy Product Support in China universal Effective capacity 2Gwh SAIC, Chang'an, Chery, Guangzhou Automobile Limited capacity, only with domestic mainstream passenger car companies Bik 8Gwh Zotye Motors, Haima Cars, Nanjing Jinlong, Lifan, JAC Domestic second- and third-line brand passenger car supply Fuenergy Technology 5Gwh Beiqi New Energy, Jiangling, Chang'an Supply of passenger car power batteries, more for the mainstream supply of brand passenger car brands Li Shen 3Gwh Dongfeng, Huatai, Jianghuai, Zhongtai, Kawei Gateway Power 1.7G wh Chang'an, Dongfeng, Zhongtai Automobile, Chery Beijing National Energy 12Gwh Ankai, Dongfeng, Nanjing Jinlong Commercial vehicle battery supply Gugli 4.5Gwh Yutong, Zhongtong, Futian, Jinlong, Ankai best red dot for medium range,best red dot finder for telescope,best red dot for distance,best red dot finder Nantong Dinggo Optical Instrument Co.,Ltd , http://www.focuhunter.store