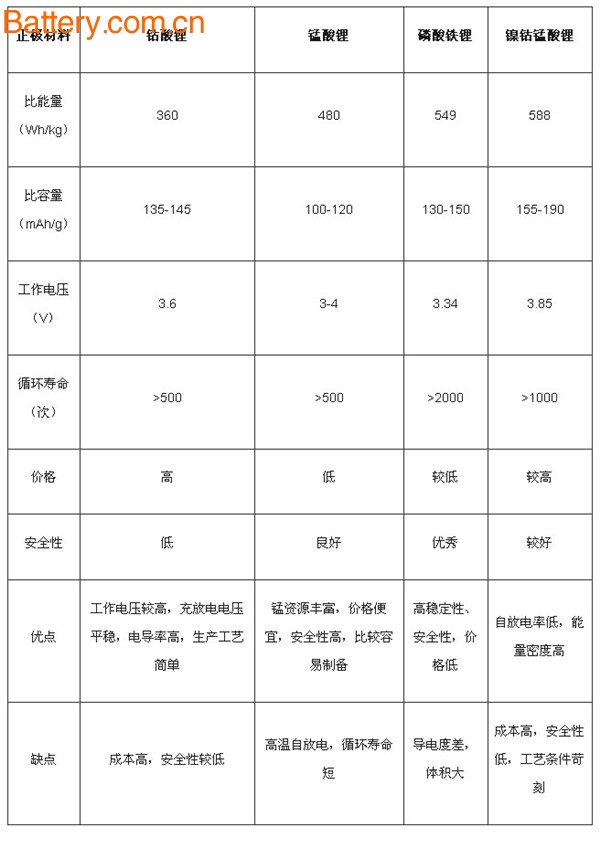

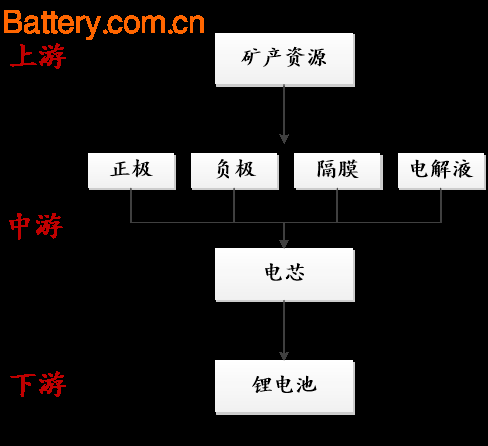

In 2016, China's new energy vehicle sales exceeded 500,000 units, and its production and sales ranked first in the world for two consecutive years. The power lithium battery is one of the three core components of the new energy vehicle, accounting for 40% of the total vehicle cost, which directly determines the performance of the vehicle. Since new energy vehicles have high requirements for power batteries, they must have specific performances of high specific energy, high specific power, fast charging and deep discharge, and require low cost and long life, so lithium ion batteries are the best choice. Watch 01 Positive electrode material is the key real shot for developing lithium battery " to create real results Composition of lithium battery The core materials of the lithium battery include a positive electrode material, a negative electrode material, an electrolyte, and a separator. The most important material of the positive electrode material is not only high quality, but also the cost is relatively high in the battery (usually more than 30%), and the technical threshold is also the highest; at the same time, since the positive electrode material is directly related to the battery capacity and safety performance, In the case where the properties of other materials are substantially similar, the performance and classification of lithium batteries generally depends on the cathode material. (1) Lithium cobaltate is the first generation of commercial lithium battery cathode material, and is also the most mature cathode material, mostly used in 3C electronic products. However, in recent years, due to the high price, low security, limited capacity, and the slow development of electronic products, there is a great possibility of being replaced; (2) Lithium manganate has a cost advantage over lithium cobaltate and is safer. However, its specific capacity is still low, and it does not solve the defect of low cycle life; (3) Power lithium battery materials such as lithium iron phosphate and nickel cobalt cobalt manganate used in new energy vehicles are developing rapidly. Compared with the first two types of lithium batteries, the lithium iron phosphate and lithium nickel cobalt manganese oxide have a large increase in capacitance, and have a long cycle life and good safety performance. Watch 02 Sanyuan materials will become mainstream in the future Most of the new energy vehicles we usually see, such as BYD new energy vehicles, have chosen to use lithium iron phosphate batteries . This lithium battery with high stability, high security, high cost and other three major advantages, and mass production technology is mature, is the first choice of power lithium battery, has been in the country occupy a higher market share. At present, the development of new energy vehicles is still the energy storage life of power batteries. At this point, lithium nickel cobalt manganese ternary materials show their unique advantages of high energy density. Although the current cost of ternary cathode materials is high and the production process is still immature, the industry's concerns about its safety have not been lifted, but only by improving the existing lithium iron phosphate battery can not meet the future mileage of new energy vehicles. Requirements, can only solve the problem by optimizing the ternary cathode material and mass production. The Tesla car we are familiar with uses a high-capacity lithium nickel cobalt manganese ternary lithium battery . Therefore, the author believes that under the premise that the fuel cell can not solve the stability and safety problems, the ternary lithium battery will become the mainstream power battery in the future, and may even dominate the market. Watch 03 Analysis of investment value of lithium battery industry chain At present, the global lithium battery market is dominated by China, South Korea and Japan. Among them, Japan and South Korea started earlier in the lithium battery industry, and the cathode material technology is relatively mature; while China has benefited from the subsidy policy for new energy vehicles in recent years, the power lithium battery industry has developed rapidly, but it still lags behind Japan and South Korea in technology. From 2005 to 2015, the global lithium battery market grew from $5.6 billion to $22.1 billion, and is expected to reach $36.3 billion in 2020. Power lithium batteries have become an important part of the lithium battery market. The upstream of the lithium battery industry is the mineral resources for the production of battery materials, including manganese, phosphorus, cobalt, nickel and other metal materials and graphite carbonized materials; the middle reaches are battery materials and batteries for cathode materials; downstream are various types of lithium battery products. So, where is the value of the investment we can explore in the lithium battery industry chain? The author analyzes as follows: 1. For the lithium battery industry, the price of raw materials is inevitably the primary factor restricting the development of lithium batteries, and it is currently in short supply. However, due to the capital-intensive and state-owned monopoly properties of the mineral development industry, it is not suitable for equity investment; 2. Due to the strong support of the state for lithium batteries, many listed companies and state-owned enterprises have poured into the field of power lithium battery equipment. It is true that many of these companies have mature production technology and market experience, but because of the low technical threshold of lithium batteries and the high cost of battery materials, the gross profit margin of their products is relatively low, and most companies have a net profit margin of less than 8 %, the investment value is not high; 3, battery materials, especially cathode materials are the key technology for the development of lithium batteries. Lithium battery development to date, its cathode material still has some technical bottlenecks, especially the advantages of high capacity and safety performance have not been fully exerted. With the national subsidy policy put forward higher requirements for the energy density and cruising range of new energy vehicles, the original lithium iron phosphate battery can not meet the market demand. Domestic lithium battery manufacturers have begun to transform and develop ternary cathode materials with higher energy density, and the future development of ternary material batteries is enormous. Therefore, considering the analysis comprehensively, the author believes that lithium battery materials, especially cathode materials, are the most innovative and investment-worthy areas in the industry chain.

Pour Point Depressant mainly has the types of PMA Polymethacrylate type and Fumarate Type with different composition. For PMA type, it includes the products of PMA Polymethacrylate Pour Point Depressant PPD T602, Polymethacrylate PMA Pour Point Depressant PPD T603; for Fumarate Type, it includes Fumarate Type Pour Point Depressant PPD T806A, Fumarate Type Pour Point Depressant PPD T806B, Fumarate Type Pour Point Depressant PPD T806C and Fumarate Type Pour Point Depressant PPD T806D.

PMA Pour Point Depressant has excellent

pour point depressing effect and shear stability, suitable for engine oil, gear

oil, hydraulic oil and other lubricating oils. It is a universal pour point

depressant, especially suitable for the formulation of base oils and group II and III hydrogenated oils with medium and low viscosity.

Fumarate Pour Point Depressant has excellent

pour point depressing and shear stability, suitable for group I and II

base oils with medium, low viscosity and shear stability, suitable for alkyl and renewable base oils.

Pour Point Depressant,Lubricant Additive Fumarate Ppd,Pour Point Depressant Lube Additive,Lube Additive Pma Polymethacrylate Zhengzhou Chorus Lubricant Additive Co.,Ltd. , https://www.cn-lubricantadditive.com