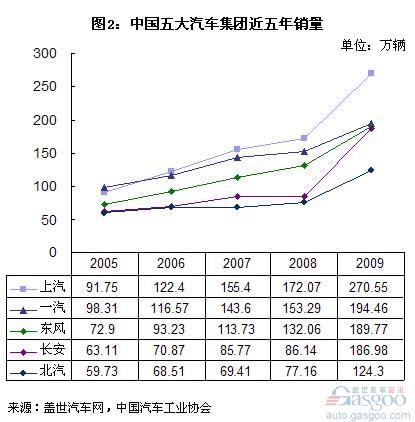

In 2009, there were five major group sales in China's auto (including passenger cars and commercial vehicles) industry exceeding 1 million, namely SAIC, FAW, Dongfeng, Changan, and Beiqi. These five major groups have been the top five automotive groups in terms of sales volume and market share in China. Their status has not been shaken by other groups. The ranking of these five major groups has also been relatively stable, but the factors of change have become increasingly apparent. Overall sales and market share of the five major groups From 2005 to 2009, the total sales volume of China's five major auto groups were respectively 3,888,000, 4,715,800, 5,679,100, 6,207,200 and 9,660,600 (see Figure 1). It can be said that the number of cars sold in many countries is worth with. From 2005 to 2008, the market share of the five major groups has been around 66%—67.00% in 2005, 65.35% in 2006, 64.60% in 2007, and 66.17% in 2008. In 2009, its market share jumped to 70.80%, mainly because the Changan Automobile Group merged Hafei and Changhe under the initiative of the “Four Big Four†automobile group proposed by the government, thereby increasing the market share of the five major groups. Changes within the five major groups In 2005, FAW Group was still the first auto group in China. Since 2006, FAW Group’s sales have been surpassed by SAIC, and the rankings of the five major groups have been SAIC, FAW, Dongfeng, Chang’an and Beiqi. However, it can be clearly seen from Figure 2 that in 2009, sales of Dongfeng Group and Changan Group are already very close to FAW Group. If it continues to grow at the speed of 2009, FAW Group will drop from the second position, Dongfeng or Chang’an. Will become second. From the perspective of sales volume, Dongfeng, Chang'an, and FAW Group saw a decrease in the sales gap when the annual sales volume reached nearly 2 million units, and 2 million vehicles were landmarks for auto companies. From the perspective of sales growth in 2009, the highest is Chang'an Group (117.07%), followed by Beijing Automotive Group (61.09%). In 2009, the sales volume was far more than 2 million units and SAIC Motor Group (57.24%) was the No. 1 supplier. Dongfeng Group (43.70%), the lowest is FAW Group (26.86%). Chang'an and Dongfeng Group's growth potential Chang'an Group's sales in 2009 increased significantly. Although it is related to indirect mergers with Hafei and Changhe, its own growth is the main thrust of its sales growth. The Dongfeng Honda within the Dongfeng Group is one of the companies with the lowest sales growth rate among key auto companies in China, but the sales volume of the entire Dongfeng Group still has a relatively high growth. In fact, the sales growth of Changan and Dongfeng Group is inevitable. In the future, its growth potential will be higher than that of FAW. The most fundamental reason for promoting sales growth of Changan and Dongfeng Group in 2009 and in the future is not the competitiveness of the internal companies themselves, but the increase in sales of Chinese automobiles (referring to new cars) will mainly come from the second, third and fourth tier cities, For the moment, most of the growth in sales will come from provinces with relatively low consumption levels in the central provinces, northern and eastern regions, but with rapid growth in GDP and per capita disposable income, and several provinces with higher GDP and per capita disposable income in the west. The Dongfeng Group and the Chang’an Group clearly occupy a geographical advantage. Its own branded car companies and joint venture car companies will be supported by local policies, priority purchases such as buses and taxis, and consumers’ awareness of the brand. Companies that set up factories in these areas later have more advantages. Machine For Plastic Lid,Paper Lid Machine Making Machine,Paper Cup Lid Machine,Plastic Cup Lid Machine Ruian Victory Machine Co.,Ltd , https://www.victorymachinemanufacturer.com