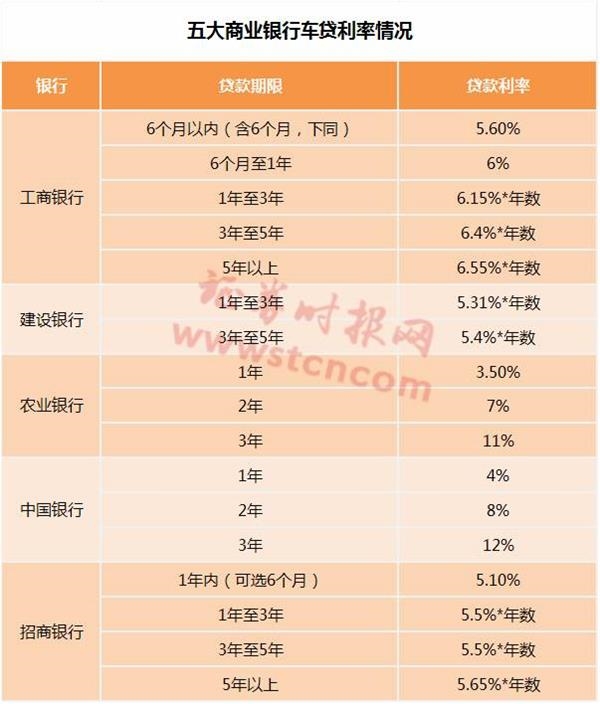

New energy vehicle stocks have recently become the focus of attention in the A-share market. For the automotive industry, in addition to new energy vehicles, intelligence, car networking, and automotive finance are also the other three key hot words in the current automobile industry. , Auto finance is undoubtedly the closest to investors' daily life. Industrial Securities Research reported that China's auto financial market has exceeded 800 billion yuan. According to the "2016 China Auto Finance Report" provided by Jianyuan Capital, in 2001, China's auto finance scale was only 43.6 billion yuan. In the past 17 years, the scale of auto finance has increased by nearly 20 times. For ordinary consumers, the rapid development of auto finance has also changed their purchasing behavior. Currently, the financial supply side of auto consumption finance in the market mainly includes banks, auto finance companies, and third-party fund lending institutions. 1. What is auto finance? To put it simply, auto finance means that banks, auto finance companies, and third-party credit companies (most of which have risen in recent years) borrow money at a certain interest rate to buy cars for consumers and charge interest. The bank has the advantage that it has plenty of capital in its hands, and auto credit is an important part of its business. The advantage of auto finance companies is that it has a large number of sales channels to facilitate the promotion of auto finance products to investors; third-party credit companies With a large amount of user information in hand, you can sell products to customers and package financial services together. Industry sources told reporters that, in general, the difficulty of auditing is inversely proportional to the level of interest rate, and the more stringent the audit conditions, the lower the interest rate. Among them, the bank's conditions are the most demanding and the interest rate is lower. Third-party companies do not have such strict requirements. Even if there are bad records of credit cards, they can lend. However, the interest rate of such companies is relatively higher. 2. How can consumers apply for consumer loans through auto finance companies? BYD Auto Finance website information shows that if you want to apply for a loan from a car company to buy a car, the process is roughly as follows: 1, online selected models; 2, submit an application; 3, loan approval; 4, sign a contract; 5, on the mortgage; 6, customers mention the car. The application procedures for SAIC GM and other auto finance companies are basically the same. 3. What are the three types of auto finance loan interest rates? a. Bank car loans By interviewing a bank account manager by telephone and combining the information collected by the interest rate information network, the car loan interest rates of ICBC, CCB, Agricultural Bank of China, China Bank, and China Merchants Bank are shown in the table below. b. Car finance company car loan Shanghai General Motors Financial website information shows that the company's car down payment can reach a minimum of 20%, the repayment period is within 12 months to 60 months, the main repayment methods are such as this repayment, equal repayment, wisdom repayment , worry-free repayment and segmented repayment and other methods. Take the Chevrolet 320 manual avant-garde model as an example. The official guide price is about 110,000 yuan, the down payment ratio is 50%, the final payment ratio is 50%, the loan term is 1 year, and the monthly payment is 605 yuan. The loan interest rate is approximately 6.6%. In the same model, the down payment ratio is 25%, the loan term is 2 years, and the monthly payment is 2920 yuan, and the loan interest rate is increased to 13.71%. The loan period is 3 years, the first payment ratio is 25%, and when the ratio of the final payment is 20%, the monthly supply is 2,285 yuan, and the loan interest rate is 15.69%. According to industry insiders, there is a direct relationship between loan interest rate and the repayment method and deadline. However, due to fierce competition in the industry, the interest rate difference between different companies at the same level is not too great. c. Third-party company car loans Mr. Su, who is engaged in the sales of BMW cars, told reporters that customers from third-party credit companies such as Autohome and Youxin used about 100,000 yuan as an example, and the interest for one year was about 5,000 yuan and 6,000 yuan. That is, interest rates are around 5% and 6%. 4. Why auto finance develops rapidly? From the bank's point of view, the bad debt rate of auto credit is very low and it is a very worthwhile investment business; for automobile companies engaged in auto finance, they have enough cash flow (or borrow a lot of cheap funds from banks). Afterwards, because it has a large number of sales channels (lending channels), it can bring new profit growth points to the company; for third-party credit companies, they have sufficient funds in their hands to lend money to customers to buy cars. Not for? Banks can provide consumers with money to buy cars through car loans or credit card installments. The down payment ratio can range from 20% to 50%. The specific installment repayment rates will continue to increase over time. Industry sources told reporters that with the increasingly fierce market competition, on the whole, the loan interest rate of the entire auto finance industry is still moving downwards. Under normal circumstances, the interest rate of car loans is that banks are smaller than auto finance companies, and third-party credit companies will be higher than auto finance companies. 5. Which listed companies are deploying auto finance business? Incomplete statistics show that among the A-share listed companies, companies involved in auto finance include SAIC, FAW Group, Guangzhou Automobile Group, Sany Heavy Industry, Changan Automobile, Great Wall Motors, Dongfeng Motor and BYD. The SAIC Group was the first to be involved in this field. SAIC General Motors Financial Co., Ltd., which is indirectly 55% owned by SAIC, was established on August 11, 2004. The corresponding auto finance companies such as Dongfeng Motor, Guangzhou Automobile Group and Sany Heavy Industry were all established before 2010. FAW Group, Changan Automobile, Great Wall Motor and BYD's auto finance companies were established after 2010. It is worth mentioning that SAIC's investment in auto finance, networking, smart driving and new energy are all increasing. In the semi-annual report of SAIC Group, the company raised 15 billion yuan in funds through a fixed increase, of which 3 billion was used for auto finance projects. The specific use of funds is to directly provide car loan services to car dealers and terminal consumers who have the need for car financing. Follow-up With the continuous development of the automotive industry, the kind of chemical effects that smart cars and automobile finance will produce deserves further attention. Zinc Kettle,Galvanizing Kettle,zinc pot Xinbai Plating(jiangsu) Intelligent Technology Co.,Ltd , https://www.hotgalvanizing.com